Painting Capital Or Expense Ato . you can claim a deduction for repair and maintenance expenses in the income year you incur them. if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. Have a read of rental expenses you can. you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or. absolutely you can claim the paint as repairs to your investment property. If you needed to install new. adding new partition walls, doors, windows, and fences that require paint work are eligible for capital works deduction claims.

from www.chegg.com

you can claim a deduction for repair and maintenance expenses in the income year you incur them. if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. absolutely you can claim the paint as repairs to your investment property. repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or. adding new partition walls, doors, windows, and fences that require paint work are eligible for capital works deduction claims. Have a read of rental expenses you can. If you needed to install new.

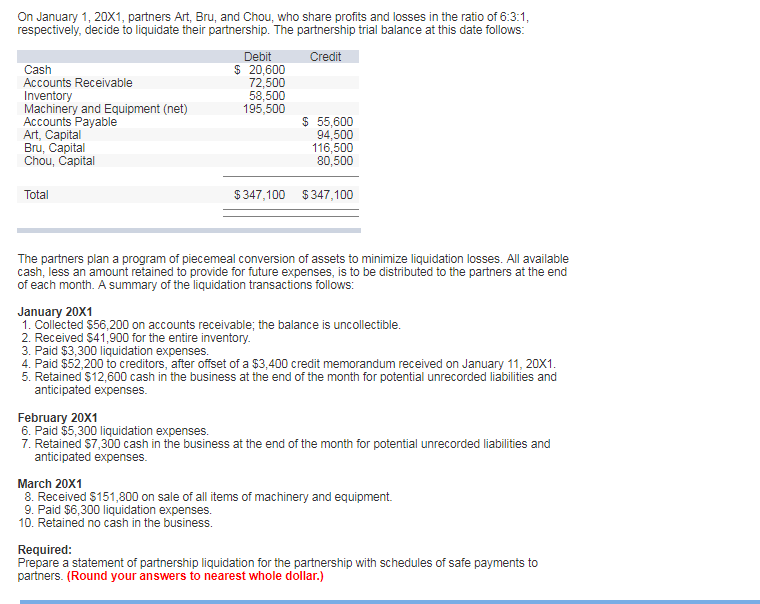

Solved On January 1, 20X1, partners Art, Bru, and Chou, who

Painting Capital Or Expense Ato you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or. If you needed to install new. adding new partition walls, doors, windows, and fences that require paint work are eligible for capital works deduction claims. repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. absolutely you can claim the paint as repairs to your investment property. Have a read of rental expenses you can. you can claim a deduction for repair and maintenance expenses in the income year you incur them. you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance.

From www.chegg.com

Solved On January 1, 20X1, partners Art, Bru, and Chou, who Painting Capital Or Expense Ato If you needed to install new. repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. you. Painting Capital Or Expense Ato.

From cellzyun.blob.core.windows.net

Painting Expense Or Capitalize Ato at Megan Fuller blog Painting Capital Or Expense Ato if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or. you can claim. Painting Capital Or Expense Ato.

From www.vecteezy.com

Capital expenditures or CapEx are a company long term expenses while Painting Capital Or Expense Ato repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. adding new partition walls, doors, windows, and fences that require paint work are eligible for capital works deduction claims. Have a read of rental expenses you. Painting Capital Or Expense Ato.

From akpainting.com

Turn Savings From Operation Expenses Into Capital Projects A & K Painting Capital Or Expense Ato you can claim a deduction for repair and maintenance expenses in the income year you incur them. if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. Have a read of rental expenses you can. repairs and general maintenance are expenses for work done to remedy, or prevent,. Painting Capital Or Expense Ato.

From www.alamy.com

capex opex capital expenditure operation expenses gear coin finace Painting Capital Or Expense Ato Have a read of rental expenses you can. you can claim a deduction for repair and maintenance expenses in the income year you incur them. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools. Painting Capital Or Expense Ato.

From cellzyun.blob.core.windows.net

Painting Expense Or Capitalize Ato at Megan Fuller blog Painting Capital Or Expense Ato if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or. you can claim a. Painting Capital Or Expense Ato.

From www.capitalelitepainting.com

Capital Elite Painting About Painting Capital Or Expense Ato If you needed to install new. you can claim a deduction for repair and maintenance expenses in the income year you incur them. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. you can. Painting Capital Or Expense Ato.

From picpedia.org

Capital Expenses Clipboard image Painting Capital Or Expense Ato you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or. you can claim a deduction for repair and maintenance expenses in the income year you incur them. repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. maintenance generally involves keeping the. Painting Capital Or Expense Ato.

From www.capitalrepaints.com.au

Commercial Painting Capital Repaints Painting Capital Or Expense Ato adding new partition walls, doors, windows, and fences that require paint work are eligible for capital works deduction claims. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. If you needed to. Painting Capital Or Expense Ato.

From www.alamy.com

Capex Capital expenditures expenses cost of corporate company Stock Painting Capital Or Expense Ato adding new partition walls, doors, windows, and fences that require paint work are eligible for capital works deduction claims. absolutely you can claim the paint as repairs to your investment property. if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. you can claim a deduction for. Painting Capital Or Expense Ato.

From www.construct.net

Essential Pixel Art Asset Pack Game Asset Packs Painting Capital Or Expense Ato repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or. if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. Have a read of. Painting Capital Or Expense Ato.

From www.educba.com

Prepaid Expenses Examples (Step by Step Create) Painting Capital Or Expense Ato absolutely you can claim the paint as repairs to your investment property. adding new partition walls, doors, windows, and fences that require paint work are eligible for capital works deduction claims. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. Have a read of rental expenses you can. if the. Painting Capital Or Expense Ato.

From www.solutioninn.com

[Solved] Carter Wilson is a painting contractor wh SolutionInn Painting Capital Or Expense Ato If you needed to install new. repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. Have a read of rental expenses you can. if the roof and gutters are both totally damaged and you restore. Painting Capital Or Expense Ato.

From www.chegg.com

Solved On January 1, 20X1, partners Art, Bru, and Chou, who Painting Capital Or Expense Ato if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. adding new partition walls, doors, windows, and fences that require paint work are eligible for capital works deduction claims. Have a read of rental expenses you can. maintenance generally involves keeping the property in a tenantable condition, for. Painting Capital Or Expense Ato.

From investoracademy.org

Assets, Liabilities, Equity The Building Blocks of a Company Painting Capital Or Expense Ato repairs and general maintenance are expenses for work done to remedy, or prevent, defects, damage or. you can claim a deduction for repair and maintenance expenses in the income year you incur them. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. Have a read of rental expenses you can. . Painting Capital Or Expense Ato.

From willowdaleequity.com

Is Painting Considered Maintenance Or a Capital Expense? Willowdale Painting Capital Or Expense Ato if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. adding new partition walls, doors, windows, and fences that require paint work are eligible for capital works deduction claims. repairs and general. Painting Capital Or Expense Ato.

From cellzyun.blob.core.windows.net

Painting Expense Or Capitalize Ato at Megan Fuller blog Painting Capital Or Expense Ato absolutely you can claim the paint as repairs to your investment property. if the roof and gutters are both totally damaged and you restore them, that would be repairs and maintenance. Have a read of rental expenses you can. maintenance generally involves keeping the property in a tenantable condition, for example repainting faded or. adding new. Painting Capital Or Expense Ato.

From www.weilerpainting.com

Is Painting Considered Maintenance? Capital Expense Expert Tips Painting Capital Or Expense Ato you can claim a deduction for repair and maintenance expenses in the income year you incur them. absolutely you can claim the paint as repairs to your investment property. you can claim a tax deduction for expenses relating to repairs, maintenance or replacement of machinery, tools or. If you needed to install new. Have a read of. Painting Capital Or Expense Ato.